At least once a year, my husband, Tony and I sit down and do a subscription audit. We review our recurring expenses, run our credit reports, and look carefully for money leaks. Not because we’re in trouble. Not because we’re panicking. But because we’re retired, debt-free except for our mortgage, and we intend to stay that way.

There is a quiet freedom in being out of consumer debt. No minimum payments. No juggling balances. Just margin and peace. Protecting that freedom requires attention.

This year’s review revealed something simple but powerful: $133.55 a month quietly leaving our household budget.

Life After Debt

Tony and I are both “retired,” though neither of us is sitting still. He works part-time — plenty of walking, good exercise, and a little extra income. I sell on eBay, Facebook Marketplace, Pango Books, and Mercari.

We’ve been officially out of debt for several years now, with the exception of our mortgage. There is a freedom in being debt-free that is hard to fully describe. No payments chasing us. No financial anxiety humming in the background. Just stability.

Once a year, we protect that stability by reviewing our budget carefully.

This Year Was Different

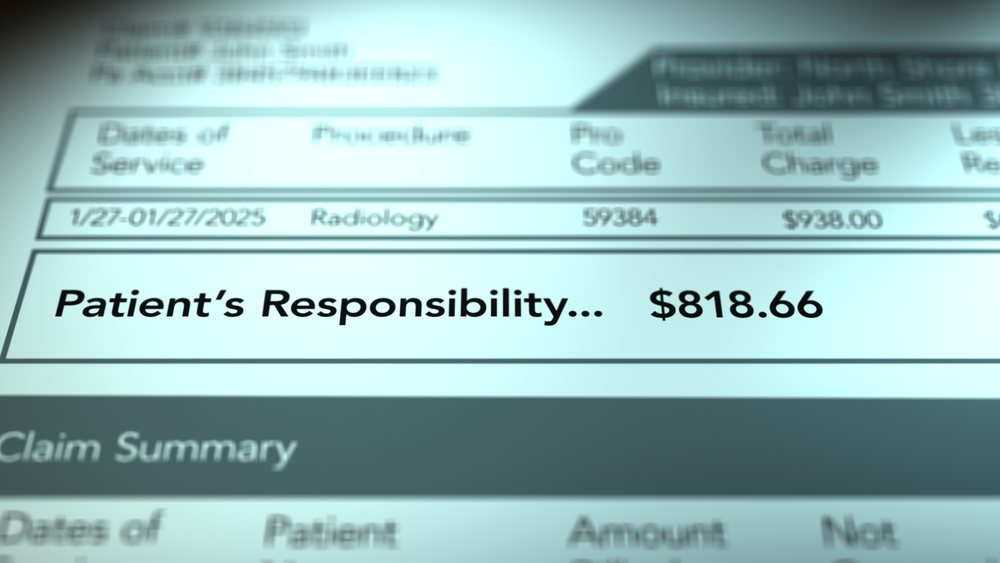

This past year was medically expensive — mostly for me. Even with good insurance and hitting my maximum out-of-pocket quickly, radiation therapy bills took time to fully clear.

A quick aside: review your medical invoices carefully. I was billed for services I did not receive at one facility. At another, payments were not properly applied. Mistakes happen. Claims are processed quickly, often by overworked people. Check your statements.

Once the medical dust settled, it was time for our annual subscription audit.

What We Changed

Here’s what we adjusted:

- $40 moved to my personal account (genealogy-related expenses)

- $39 eliminated completely

- $37.51 streaming subscription cancelled

- $9.05 streaming subscription cancelled

- $7.99 streaming subscription cancelled

That’s $133.55 removed from our household budget each month — and $93.55 permanently gone.

Over a year, that equals:

- $1,602.60 shifted out of the household budget

- $1,122.60 no longer being spent at all

This didn’t require a dramatic lifestyle overhaul. It required one quiet afternoon and a willingness to look closely.

Streaming subscriptions are often the worst offenders. The “only $9.05 a month” channel you needed for one season. The free trial you forgot to cancel. The service you thought you might use someday.

Individually, they seem small.

Together, they leak.

“It’s Only $133.55…”

$133.55 a month may not sound dramatic. We’re fairly conservative about what we sign up for. We don’t impulse-buy subscriptions. We don’t carry balances. We don’t pay credit card interest. (Other than our mortgage, we avoid interest entirely.)

Some financial experts recommend cutting up credit cards altogether. That works for some people. For us, the key isn’t avoiding credit cards — it’s using them carefully and paying them off in full every month. Vigilance matters more than plastic.

Still, even in a conservative household, money can leak.

And on a fixed income, $133.55 isn’t small.

It can cover a utility bill.

It can offset a property insurance increase.

It can go toward extra mortgage principal.

Or it can simply provide breathing room when medical expenses show up.

When income is steady but limited, every dollar has an assignment.

Removing $133.55 from the household budget doesn’t feel extreme — it feels responsible.

We didn’t overhaul our lifestyle.

We just paid attention.

Do This Today: A Simple Subscription Audit

If you haven’t reviewed your recurring expenses in a while, here’s a practical way to start:

1. Log in to your credit card accounts.

Scroll through the last three months of charges. Don’t skim. Actually look.

2. Make a list of every recurring charge.

Streaming services. Apps. Memberships. Cloud storage. Subscriptions you forgot you had.

3. Ask one question for each item:

If I had to sign up for this again today, would I?

If the answer is no, cancel it.

4. Check your medical statements carefully.

Confirm payments were applied correctly. Make sure you actually received the services billed.

5. Separate personal expenses from household expenses.

If something is yours alone — a hobby, genealogy research, a professional subscription — consider funding it from your own income stream. Clarity matters.

You don’t have to change everything.

Cancel one thing.

Move one expense.

Plug one leak.

Financial peace isn’t maintained by dramatic gestures.

It’s maintained by quiet reviews.

And sometimes, it starts with $133.55.